The transaction will record the bonus expense based on the information available. Account Debit Credit Bonus Expense 100,000 Accrued Bonus Payable 100,000 The journal entry is debiting bonus expense of $ 100,000 and credit accrued bonus payable of $ 100,000.

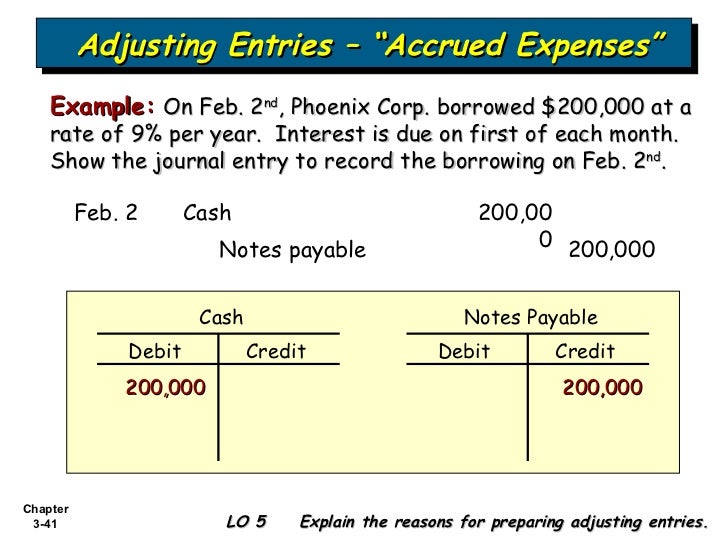

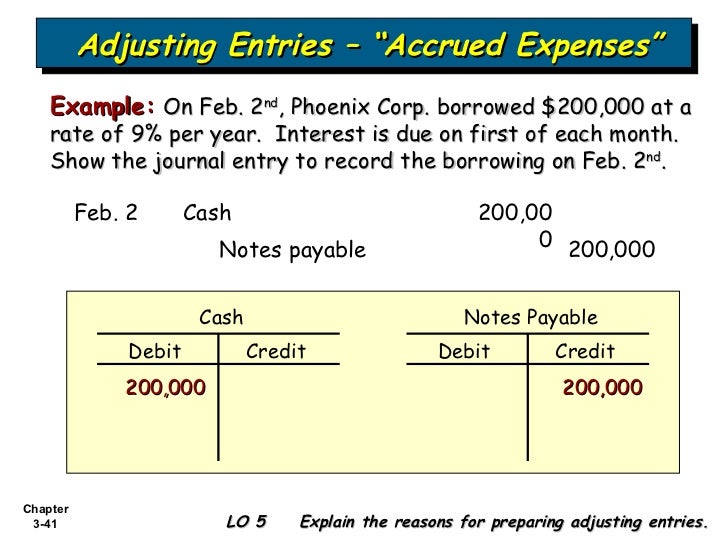

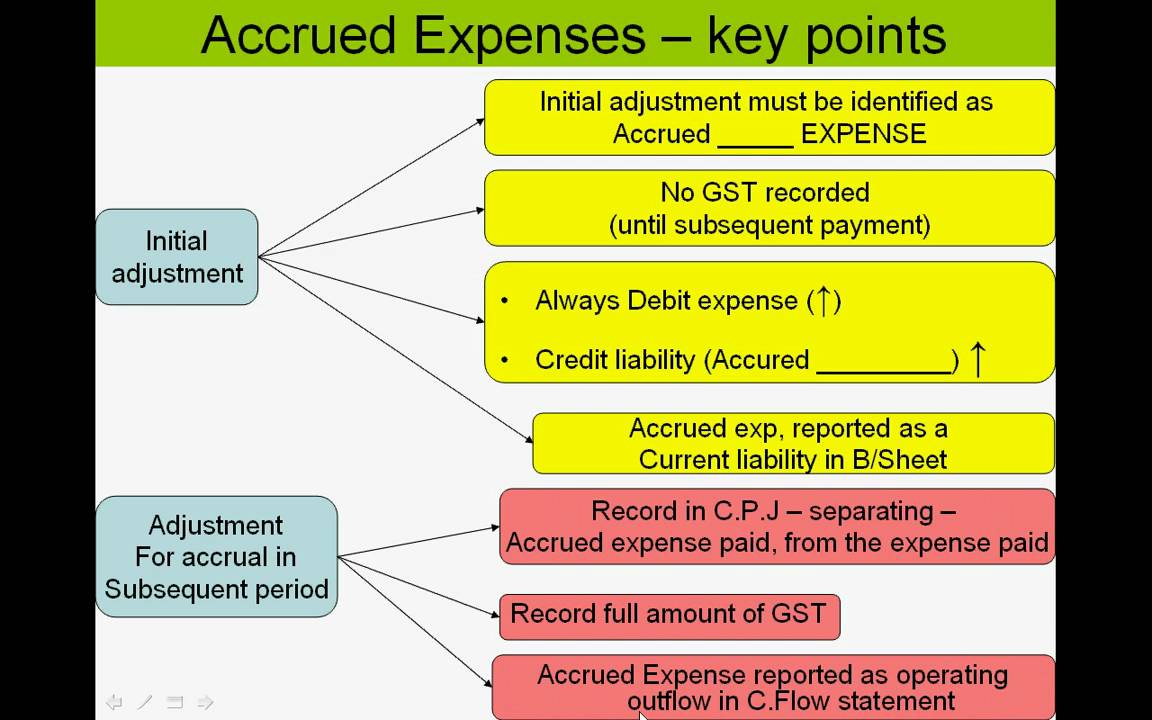

Company has to record bonus expenses and accrued bonuses payable. Please prepare the journal entry for the accrued bonus.Īt the end of the year, company estimates the bonus to record in the income statement. The actual bonus increase to $ 120,000 and was paid two months after year-end. So management decide to record this amount as the accrued bonus for the year.Īfter the year-end, the audit has reviewed the financial statement and the profit is more than the expectation. Based on the budget, the bonus for the year is estimated to be around $ 100,000 if the profit hits the target. Accrued Bonus Journal Entry ExampleĬompany ABC is preparing the annual financial statement. If it is lower, it will reduce the new year expense. If the actual payment is higher than estimated, the difference will record as an expense in the new year. The expense is only recorded in the previous year. The cash decreased as the company paid employees. If we combine both transactions, there is no current liability on the balance sheet. The amount recorded will depend on the actual amount, not the estimated one. Account Debit Credit Bonus Expense $$$ Cash $$$ When company makes the actual payment, the journal entry is debiting bonus expense and credit cash. The difference between the estimate and the actual amount will automatically take into account. When the actual bonus is made, the company will record bonus expenses and cash paid out. This transaction will reverse the accrued transaction in the previous years. Account Debit Credit Accrued Bonus Payable $$$ Bonus Expense $$$ The journal entry is debiting accrued bonus payable and credit bonus expense. It aims to remove the current liability and bonus expense. Expense is included in the income statement, the unpaid balance will record as the liability.Īt the beginning of the new year, the accountant has to reverse the above transaction. It will complete the financial statement based on the best estimation. The transaction will increase the bonus expense and current liability. Account Debit Credit Bonus Expense $$$ Accrued Bonus Payable $$$ The journal entry is debiting bonus expense and credit accrued bonus payable. However, company has not yet made a payment, so it is the liability which presents on balance sheet.

The company needs to estimate the accrued bonus and record it as an expense on the income statement. When the company prepares the financial statements, accountants have to include all revenue and expenses. The expense will be present on income statement while the liability present on balance sheet. This estimated amount is the accrued bonus which will record in both income statement and balance sheet. So managements have to estimate the accrued bonus and record it into the income statement. The bonus expense is not yet finalized due to profit while the profit depends on the bonus expense too. Bonus is the expense during the year, it is based on the company profit which is not yet clarified due to the audit and other issues. they have to include all the revenue and expense in the income statement. Again it depends on the company policy.Īt the end of the year, company needs to prepare the annual financial statements. It will be shared within a few months after the release of the annual report. The company will share a bonus after the year-end when the net profit is properly calculated. Most companies use this system to motivate the employees who work hard and give them the reward they deserve. It may be different depending on the company policy. Each employee will receive a bonus based on the performance evaluation. The head of each department will share the bonus with all employees under their supervision. The bonus package will be allocated to all departments. It is the link between company profit and employees’ benefit. The bonus is set during the budget preparation, the company will provide a package bonus to all employees when the profit reaches a certain level.

it helps to encourage the employees to work harder and achieve more profit in the upcoming year. Accrued bonus is the amount of performance bonus that company estimate before the year-end to finalize the annual financial statement.īonus is the additional benefit that company provides to the employee base on the performance of company and employee.

0 kommentar(er)

0 kommentar(er)